The journey toward a secure and prosperous retirement has undergone a radical transformation in the wake of shifting global economic policies and the rise of digital asset classes. For the modern investor, the traditional “set and forget” mentality of the past century no longer suffices in an environment characterized by fluctuating inflation and rapid technological disruption.

Building a high-return retirement portfolio today requires a sophisticated blend of traditional stability and aggressive growth engines that can outpace the rising cost of living. It is no longer enough to simply save; one must strategically deploy capital into diverse vehicles that offer both compound interest benefits and significant capital appreciation. As we move deeper into 2025, the intersection of artificial intelligence, green energy, and emerging markets provides a fertile ground for those willing to refine their investment thesis.

Success in this arena demands a meticulous understanding of risk tolerance, time horizons, and the subtle art of rebalancing assets to capture gains while protecting the principal. This guide is designed to deconstruct the most effective high-return strategies currently available, providing you with a roadmap to achieve financial sovereignty in your golden years. By adopting a proactive and informed approach, you can transform your retirement fund from a mere safety net into a powerful engine of generational wealth.

The Foundation of Modern Wealth Building

Retirement planning is fundamentally a race against time and the eroding power of inflation. To win this race, your portfolio must generate returns that significantly exceed the annual increase in consumer prices.

A high-return portfolio is not about gambling on speculative “meme” stocks or unproven trends. Instead, it is about identifying structural shifts in the global economy and positioning your assets to benefit from those long-term movements.

The core philosophy of a modern retirement strategy is “Aggressive Diversification.” This means spreading your risk across different sectors and geographies while maintaining a heavy focus on assets that historically provide double-digit annual returns.

Core Components of a High-Return Strategy

Every successful retirement engine is built upon several key pillars that work in harmony to produce consistent growth. Understanding these components is the first step toward taking control of your financial destiny.

A. Equities and Growth Stocks

-

Publicly traded companies remain the most accessible way for individuals to participate in global economic growth.

-

Focusing on “Blue Chip” technology firms and innovative startups allows you to capture the upside of the digital revolution.

-

Dividend-paying stocks provide a dual benefit of share price appreciation and a steady stream of passive income.

B. Real Estate and Tangible Assets

-

Physical property has long been a favorite of the wealthy for its ability to provide rental income and tax advantages.

-

Real Estate Investment Trusts (REITs) offer a way to invest in large-scale commercial property without the hassle of being a landlord.

-

Land and raw materials act as a natural hedge against currency devaluation and provide a “floor” for your portfolio value.

C. Alternative Investments and Private Equity

-

Accessing private markets can lead to much higher returns than those found on the public stock exchanges.

-

Venture capital and hedge funds allow you to invest in the next generation of industry leaders before they go public.

-

Digital assets, including established cryptocurrencies, have become a legitimate part of a modern, high-alpha retirement strategy.

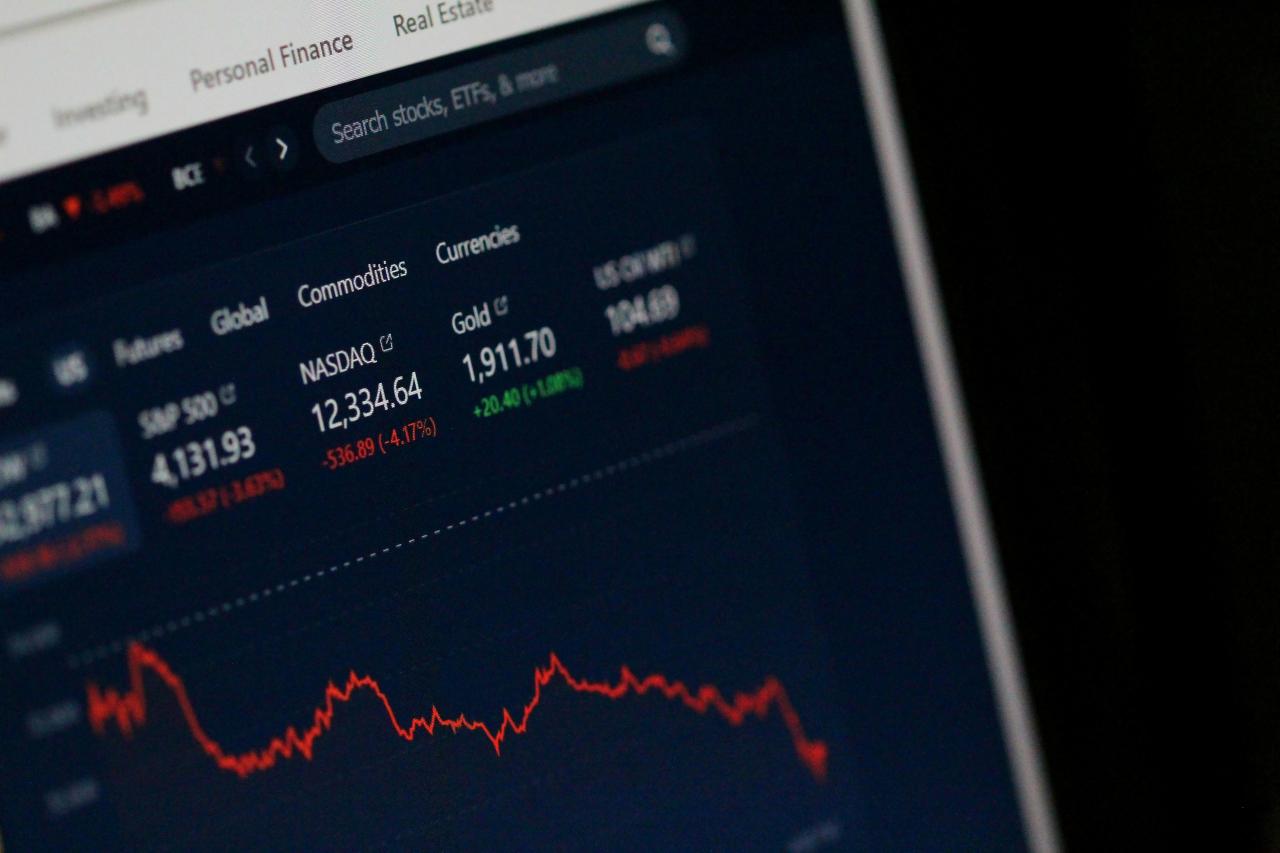

Navigating the Technology Sector Boom

Technology continues to be the primary driver of stock market returns, fueled by breakthroughs in generative AI and quantum computing. A high-return portfolio in 2025 must have a significant weight in the companies that provide the “shovels and picks” for this digital gold rush.

This includes semiconductor manufacturers, cloud infrastructure providers, and software firms that are successfully integrating AI into their business models. These companies often enjoy high profit margins and a “moat” that protects them from competitors.

However, it is vital to distinguish between hype and actual earnings. Investors should look for tech firms with strong balance sheets and a proven ability to generate free cash flow, rather than just rapid user growth.

The Power of Emerging Markets

While the US and European markets offer stability, the highest growth potential often lies in the developing economies of Southeast Asia, India, and parts of Africa. These regions are experiencing a rapid rise in the middle class and a massive wave of urbanization.

A. Demographic Dividends

-

Countries with young, growing populations provide a massive labor force and a burgeoning consumer base.

-

This demographic shift drives demand for everything from banking services to consumer electronics.

-

Investing in these regions allows you to capture growth that is no longer possible in “aging” developed nations.

B. Infrastructure Development

-

Emerging nations are spending billions on new ports, highways, and energy grids to support their industrial growth.

-

Companies involved in these projects often see massive contract wins and long-term revenue stability.

-

Government-backed bonds in these regions can also offer much higher yields than traditional western treasury bills.

C. Technological Leapfrogging

-

Many developing nations are skipping old technologies and going straight to mobile banking and renewable energy.

-

This creates unique investment opportunities in local fintech and green-tech companies that are solving local problems.

-

Being an early investor in these “local champions” can lead to life-changing returns over a twenty-year retirement horizon.

Risk Management and Portfolio Rebalancing

High returns always come with higher levels of volatility. The secret to long-term success is not avoiding risk, but managing it through strategic rebalancing and the use of protective financial instruments.

A. The Art of the Rebalance

-

When one asset class performs exceptionally well, it can become too large a percentage of your total portfolio.

-

Selling a portion of your “winners” to buy “undervalued” assets ensures that you are always buying low and selling high.

-

This disciplined approach prevents you from being over-exposed to a single market crash.

B. Utilizing Options and Hedging

-

Sophisticated investors use “put options” as an insurance policy for their stock holdings during times of market uncertainty.

-

This allows you to stay invested for the long-term while limiting the potential downside of a sudden market drop.

-

Hedging is essential for a high-return portfolio because it gives you the confidence to stay the course when others are panicking.

C. Stop-Loss Orders and Exit Strategies

-

Having a clear plan for when to exit a position is just as important as knowing when to enter.

-

Automated stop-loss orders can protect your capital by selling a stock if it drops below a certain price point.

-

This removes the “emotional” element of investing, which is the number one cause of significant financial loss.

Tax-Efficient Investing for Maximum Gains

It’s not about how much you make; it’s about how much you keep. Understanding the tax implications of your investments can add 1% to 2% to your annual net returns, which compounds into a massive sum over decades.

Utilizing tax-advantaged accounts like IRAs or 401(k)s in the US, or similar structures globally, is the most effective way to protect your growth. These accounts allow your investments to grow tax-free or tax-deferred, giving you more capital to reinvest every year.

Strategic tax-loss harvesting is another powerful tool. This involves selling “losing” investments to offset the capital gains taxes you owe on your “winners,” effectively lowering your tax bill while keeping your portfolio balanced.

The Role of Passive Income in Retirement

A high-return portfolio should eventually transition from a “growth” engine into an “income” engine. This ensures that you can live off the distributions of your assets without ever having to sell the underlying principal.

A. High-Yield Dividend Portfolios

-

Focusing on “Dividend Aristocrats”—companies that have increased their payouts for over 25 years—provides a reliable “raise” every year.

-

These dividends can be reinvested during your working years to accelerate the compounding process.

-

Once you retire, these payments hit your bank account like a monthly salary.

B. Peer-to-Peer Lending and Private Debt

-

Modern platforms allow you to act as the bank, lending money to individuals or small businesses for a fixed interest rate.

-

These “private debt” instruments often yield much higher returns than traditional government bonds.

-

It adds a layer of diversification that is not directly correlated with the fluctuations of the stock market.

C. Staking and Yield Farming in Digital Assets

-

For those comfortable with technology, “staking” certain digital assets allows you to earn rewards for securing a network.

-

This can provide high yields, though it comes with the technical and volatility risks associated with the crypto market.

-

It represents the “frontier” of passive income in the digital age.

Conclusion

Achieving a high-return retirement requires a shift from passive saving to active investing. Inflation is a constant threat that only aggressive growth can effectively neutralize. Diversification across sectors and geographies is the best defense against market volatility.

Technology and emerging markets remain the most potent engines for capital appreciation. Risk management tools like rebalancing and hedging are essential for long-term survival. Tax efficiency is the hidden lever that can significantly boost your final portfolio value.

Passive income streams ensure that you never outlive your financial resources. The earlier you begin the compounding process, the less capital you need to deploy. Staying informed about global economic shifts is a full-time responsibility for the serious investor. The ultimate goal of a high-return portfolio is to provide you with the freedom of time.