The financial world is currently undergoing a massive structural transformation as we witness the peak of the Great Wealth Transfer across the globe. Trillions of dollars are moving from the baby boomer generation into the hands of younger, tech-savvy heirs who have vastly different investment priorities than their predecessors.

This new wave of investors is moving away from traditional “60/40” stock and bond splits in favor of complex, multi-asset portfolios that offer both stability and growth. Unlike the previous generation, these heirs are deeply concerned with global diversification, impact investing, and the inclusion of digital assets within their long-term strategies.

Financial institutions are scrambling to adjust their offerings to meet this demand for more sophisticated and flexible wealth management tools. The shift is not just about changing the numbers on a balance sheet; it is about a fundamental change in the philosophy of what money is for and how it should be protected.

As this inherited capital floods the market in late 2025, it is creating new opportunities for multi-asset funds that can handle the volatility of a modern, interconnected economy. This article will explore why this shift is happening and how savvy investors can position themselves to ride the wave of this historical financial transition.

The Great Wealth Transfer Reality

We are officially entering the most significant era of capital relocation in human history. As elderly investors pass down their estates, the younger generation is inheriting portfolios that have been static for decades.

These heirs are quickly liquidating traditional holdings to build something that reflects the current geopolitical and technological landscape.

Defining the Multi-Asset Strategy

A multi-asset portfolio is a strategy that combines different classes of investments to reduce overall risk and improve returns. Instead of just buying stocks, this approach includes real estate, commodities, private equity, and even specialized insurance products.

The goal is to ensure that when one sector of the economy fails, another sector is positioned to thrive and cover the losses.

A. Global equities across developed and emerging markets to capture worldwide growth.

B. Fixed income instruments including government bonds and high-yield corporate debt.

C. Real assets such as commercial real estate, farmland, and precious metals like gold.

D. Alternative investments including hedge funds, private credit, and venture capital.

Why Heirs are Abandoning Traditional Portfolios

The old way of investing was designed for a world with low inflation and predictable interest rates. Today’s heirs realize that the traditional stock-bond correlation is no longer a reliable safety net during market crashes.

They are seeking “non-correlated” assets that don’t all move in the same direction when the news cycle turns negative.

The Rise of Alternative Investments

Younger investors have a much higher appetite for private markets compared to their parents or grandparents. They are increasingly comfortable locking their money away in private equity or startup seed rounds for five to ten years.

This shift toward “illiquidity” is a major reason why multi-asset funds are seeing record-breaking inflows this December.

A. Private equity buyouts that offer the potential for much higher returns than public markets.

B. Venture capital focused on AI, biotechnology, and sustainable energy solutions.

C. Private credit lending which provides steady income through direct loans to mid-sized companies.

D. Collectibles and fine art which act as a store of value during times of high currency volatility.

Impact Investing and ESG Integration

For the modern heir, wealth building is no longer just about the bottom line or quarterly profit margins. Ethical considerations, environmental impact, and social governance (ESG) are now core requirements for any new investment.

This generation wants to ensure their inherited wealth is contributing to a better world while it grows in value.

The Digital Asset Integration

The inclusion of Bitcoin, Ethereum, and tokenized real estate has moved from the fringe to the mainstream portfolio core. Heirs view digital assets as a necessary hedge against the devaluation of traditional fiat currencies and central bank policies.

Multi-asset portfolios in 2026 are increasingly allocating between 1% and 5% to these highly liquid digital stores of value.

A. Direct ownership of digital currencies stored in secure institutional-grade vaults.

B. Staking and yield farming on decentralized finance (DeFi) platforms for passive income.

C. Tokenized real estate which allows for fractional ownership of high-value city properties.

D. Exposure to the blockchain infrastructure companies that power the new global internet.

Managing Global Geopolitical Risk

The world is more divided than ever, and investors are using multi-asset strategies to protect themselves from local shocks. By holding assets in different jurisdictions, heirs can shield their wealth from localized political instability or tax changes.

This “Global Citizen” approach to wealth management is a hallmark of the 21st-century investor philosophy.

The Importance of Cash and Liquidity

Despite the push for long-term assets, keeping a significant cash “war chest” is still a vital part of the strategy. Money market funds have hit record highs as investors wait for the perfect moment to deploy capital into distressed assets.

Having liquid cash allows an investor to be a “buyer of last resort” when everyone else is panicking.

A. High-yield savings accounts that take advantage of the current interest rate environment.

B. Short-term Treasury bills that offer maximum safety and quick access to funds.

C. Liquid multi-strategy hedge funds that can be cashed out within thirty to sixty days.

D. Strategic cash reserves held in multiple currencies to hedge against a falling dollar or euro.

The Role of Family Offices

Ultra-high-net-worth heirs are increasingly moving their money into private “Family Offices” rather than big retail banks. These offices provide bespoke multi-asset management that is tailored specifically to the family’s unique goals and values.

They act as a shield, protecting the wealth from excessive fees and ensuring the legacy lasts for several more generations.

Tax Optimization in a Changing World

Inheriting wealth often comes with a massive tax bill that can strip a portfolio of its long-term potential. Modern wealth managers use “Tax-Loss Harvesting” and complex trust structures to minimize the drag on the portfolio.

Multi-asset strategies are designed to be “tax-aware,” focusing on the net return after the government takes its share.

A. Utilization of charitable lead trusts to reduce estate taxes while supporting social causes.

B. Strategic use of life insurance policies to provide tax-free liquidity for future heirs.

C. Moving assets into tax-advantaged jurisdictions or “opportunity zones” for development.

D. Gifting strategies that take advantage of annual exclusions to slowly move wealth over time.

Technology and AI in Wealth Management

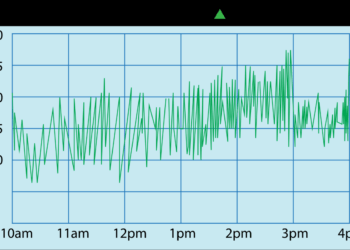

The heirs of 2026 are using sophisticated AI tools to monitor their multi-asset portfolios in real-time. These AI agents can scan global news, weather patterns, and shipping data to predict market movements before they happen.

This “Quant-Mental” approach combines human intuition with the raw processing power of modern machine learning.

The Psychological Shift of Inheritance

Receiving a large sum of money can be a traumatic or overwhelming experience for many young people. There is a growing trend of “Wealth Psychology” coaching to help heirs manage the responsibility of their new status.

The goal is to move from a “spending” mindset to a “stewardship” mindset that focuses on long-term preservation.

A. Family meetings to discuss the historical origins of the wealth and the future vision.

B. Mentorship programs where older investors teach the younger generation about risk management.

C. Philanthropic foundations that allow heirs to practice managing capital in a low-risk environment.

D. Developing a “Family Constitution” that outlines the rules for how the money can be used.

Real Estate: Still the King of Stability

Even with the rise of digital tech, physical land remains one of the most popular assets for inherited wealth. However, the focus has shifted from simple residential rentals to “Industrial Logistics” and “Data Center” properties.

These types of real estate provide the backbone for the digital economy and offer incredibly stable, long-term yields.

Dealing with High Inflation Environments

Inflation is the silent killer of wealth, and traditional bonds often fail to keep up with rising prices. Multi-asset portfolios use “Inflation-Linked” bonds and commodities like oil and copper to protect purchasing power.

When the price of bread and fuel goes up, these assets typically rise in value as well, protecting the heir’s lifestyle.

Scaling the Strategy for the Average Investor

You don’t need a billion dollars to take advantage of the multi-asset shift that is currently happening. New “Exchange Traded Funds” (ETFs) allow regular investors to buy into private equity and commodities with a single click.

The democratization of high-end finance is one of the most positive outcomes of this technological revolution.

A. Low-cost multi-asset ETFs that automatically rebalance based on market conditions.

B. Fractional investing platforms for fine art, classic cars, and rare wine collections.

C. Robo-advisors that use modern portfolio theory to create a custom mix for any budget.

D. Crowdfunded real estate platforms that allow you to own a piece of a shopping mall or office tower.

The Future of Wealth Preservation

As we look toward the 2030s, the concept of a “portfolio” will continue to expand and evolve. We may see the inclusion of personal data rights or carbon credits as standard asset classes in every portfolio.

The winners of the next decade will be those who can adapt to these changes without losing sight of the fundamentals.

Conclusion

The Great Wealth Transfer is rewriting the rules of the global financial game. Traditional investment models are being replaced by dynamic and complex multi-asset strategies. Younger heirs are prioritizing sustainability and digital innovation over the status quo.

Diversification across different asset classes is the only true defense against market volatility. Alternative investments like private equity are becoming essential for long-term growth. The inclusion of digital assets is now a standard practice for the modern billionaire.

Tax optimization and estate planning are more important than ever in a high-tax world. Technology is empowering investors to manage their wealth with unprecedented levels of precision.

Human psychology remains the biggest challenge to successful long-term wealth stewardship. The future of wealth building is multi-asset, global, and deeply integrated with technology.