The Mental Blueprint for Financial Success

When analyzing the lives of individuals who have successfully built substantial, lasting wealth, it quickly becomes clear that their success is rarely attributed solely to luck, inherited fortune, or even superior education; rather, the most decisive factor is an underlying, deeply ingrained Psychological Framework that governs their decision-making. While strategic investment knowledge and disciplined saving are certainly crucial, they function merely as tools wielded by a more powerful, unseen force: a specific set of beliefs, attitudes, and emotional responses toward money, risk, and failure.

This sophisticated Millionaire Mindset is not an innate trait but a learned system of thinking that prioritizes long-term gain over immediate gratification, views obstacles as learning opportunities, and maintains an unwavering commitment to personal growth and financial literacy. Failing to cultivate this mental blueprint means even the best investment strategies are likely to be derailed by fear during market downturns or temptation during economic booms, making the inner game of wealth creation the most essential battle to win. Ultimately, understanding and intentionally adopting the psychological habits of high-net-worth individuals is the true key to unlocking enduring financial success.

Phase One: Mastering Delayed Gratification

The most fundamental psychological hurdle to overcome on the path to significant wealth is the natural human inclination toward Instant Gratification. True wealth building demands the ability to sacrifice present comforts for future abundance.

This behavioral discipline forms the bedrock of a high savings rate and consistent investment. Without it, financial goals constantly remain just out of reach due to impulsive spending.

A. The Concept of Time Preference

Time Preference is an economic concept describing how much an individual values a present good over a future good. Those who build wealth have a Low Time Preference.

-

A person with a high time preference will immediately spend a bonus or a raise on a new car or vacation, valuing the immediate satisfaction.

-

A person with a low time preference will automatically invest that same bonus, prioritizing the compounded, long-term wealth the money will generate decades from now.

-

Developing a low time preference is achieved by consistently reminding oneself of the exponential future payoff of today’s financial sacrifice.

B. Automating Savings Before Spending

The most effective practical application of delayed gratification is Automating Savings, ensuring that a portion of every paycheck is allocated to investment accounts before any discretionary spending occurs.

-

This removes the emotional decision-making process from saving. You cannot spend money that you never see in your checking account.

-

Treating investments as a non-negotiable fixed expense, like rent or a mortgage payment, reinforces the habit of prioritization.

-

Automating transfers is a strategic way to bypass the temptation of immediate spending, directly supporting the long-term investment plan.

C. The Psychological Power of Compounding

To sustain the sacrifice required by delayed gratification, the wealthy mindset constantly visualizes and focuses on the Psychological Power of Compounding.

-

Compounding is the visible, tangible reward for the initial sacrifice. Seeing investments grow helps reinforce the value of patience and consistency.

-

The early years of investing can feel slow, as personal contributions dominate the returns, but the low time preference investor remains patient, knowing the exponential growth comes later.

-

This forward-looking focus makes the temporary discomfort of disciplined saving feel worthwhile and even necessary.

Phase Two: Adopting an Abundance Mindset

Many people subconsciously hold limiting beliefs about money, often rooted in a Scarcity Mindset that views resources as finite and money as something to be hoarded or chased. The millionaire mind operates from a perspective of Abundance.

This mindset shift changes the approach from defensive avoidance to proactive opportunity seeking. It fosters growth rather than stagnation.

A. Viewing Money as a Tool, Not a Goal

The financially successful view Money as a Tool—a resource to be deployed, invested, and utilized to create more value—rather than the ultimate end goal of life itself.

-

They understand that the true value of money lies in its ability to generate passive income, provide security, and purchase time and freedom.

-

A scarcity mindset sees a cost as a permanent loss, while an abundance mindset sees a strategic expense (like education or quality business software) as an investment with a high expected return.

-

This transactional view of capital enables calculated risk-taking, which is essential for achieving above-average investment returns.

B. Embracing Risk and Calculated Failure

The abundance mindset accepts that Risk is Necessary for growth. Failure is not seen as a permanent identity but as valuable, temporary data points for learning and correction.

-

Wealthy individuals engage in calculated risk-taking, rigorously analyzing the potential downside before committing capital, but they do not allow the fear of failure to paralyze them.

-

They understand that diversification is the structural defense against catastrophic, idiosyncratic risk, allowing them to take more measured risks on the growth portion of their portfolio.

-

The ability to analyze a failure, extract the lessons, and immediately pivot is a powerful psychological trait that separates successful entrepreneurs and investors from those who give up easily.

C. The Focus on Value Creation

An abundance-oriented individual primarily focuses on Creating Value for others, understanding that true wealth is a direct reflection of the scale and quality of the problems they solve.

-

Instead of solely focusing on earning a paycheck, they concentrate on providing exceptional products, services, or solutions that genuinely improve customers’ lives.

-

This value creation naturally leads to higher income and scalable business opportunities, as the market rewards those who effectively solve large-scale problems.

-

This psychological orientation shifts the focus from “what can I get?” to “what can I give?”—which paradoxically leads to greater financial reward.

Phase Three: Emotional Discipline During Volatility

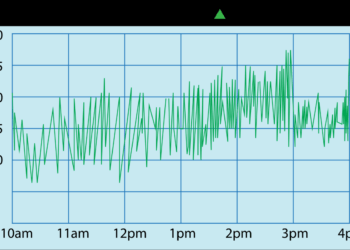

The market is inherently volatile, yet the vast majority of financial mistakes are made not because of poor market conditions, but because of an investor’s poor emotional response to those conditions. Emotional Discipline is paramount.

Market noise and short-term price swings can trigger powerful, primitive responses like fear and greed. The successful investor must override these impulses with rational, pre-determined strategies.

A. Neutralizing the Fear of Missing Out (FOMO)

FOMO (Fear of Missing Out) is a powerful psychological trap driven by greed and social comparison, leading investors to buy assets at peak valuations just before a correction.

-

The disciplined mindset sticks to a pre-defined investment strategy and asset allocation, refusing to chase headline-making stocks or fleeting investment fads.

-

Wealthy investors understand that missing out on a temporary, irrational boom is preferable to participating in a subsequent, devastating bust.

-

Their focus remains fixed on the intrinsic value of the underlying assets, not on the emotional price movements driven by public speculation.

B. Counteracting Panic Selling During Crashes

Panic Selling is the single most destructive action an investor can take, locking in permanent losses and stopping the compounding engine during the crucial recovery period.

-

The disciplined investor recognizes that market crashes are a normal, necessary part of the economic cycle, and they are, in fact, the Greatest Opportunity to buy high-quality assets cheaply.

-

They employ an automated system, such as Dollar-Cost Averaging (DCA) and Portfolio Rebalancing, which forces them to buy more during times of market fear, exploiting the lower prices.

-

Psychologically, they view a market decline not as a reduction in wealth, but as a temporary reduction in the market price of their future income streams.

C. The Importance of Routine and Consistency

Consistency, driven by a reliable Investment Routine, is the psychological antidote to volatility and uncertainty. Routine eliminates the need for daily, stressful decision-making.

-

A successful investor does not wake up every day and decide whether or not to invest; they follow a monthly or bi-weekly automated schedule that executes the plan regardless of the news cycle.

-

The routine includes systematic portfolio rebalancing, which forces the investor to Sell High and Buy Lowperiodically, removing emotional biases from the critical allocation decisions.

-

This behavioral commitment ensures that the investor remains disciplined during the boring periods, which are often the most important for compounding wealth.

Phase Four: Cultivating Financial Literacy and Humility

True financial security is built on a foundation of continuous learning and intellectual honesty. The millionaire mindset is characterized by a lifelong commitment to Financial Literacy and the humility to acknowledge one’s own limitations.

Never stop learning is a critical psychological requirement. The financial world is constantly changing, and a static knowledge base inevitably leads to outdated strategies and poor decisions.

A. Investing in Financial Education

Successful wealth builders see Financial Education as a crucial, ongoing investment, not a one-time chore. This includes self-study, reading, and mentorship.

-

They continuously read books and reputable sources on economic history, investment strategies, and personal finance to deepen their understanding of systemic risks and opportunities.

-

Financial literacy is viewed as the internal competitive advantage that allows them to recognize and avoid complex, high-fee products marketed by the financial industry.

-

The time spent educating oneself on asset allocation and tax efficiency yields a significantly higher return on investment than almost any other expenditure.

B. Practicing Intellectual Humility

Intellectual Humility is the psychological trait that prevents disastrous investment mistakes. It is the acknowledgement that no one can consistently predict the future.

-

The wealthy investor avoids the arrogance of believing they are smarter than the market, leading them to use diversified, low-cost index funds rather than attempting to pick individual stocks repeatedly.

-

Humility allows them to stick to a diversified asset allocation, knowing that one segment of the market will inevitably underperform, and one will inevitably outperform.

-

It also enables them to hire experts (accountants, estate planners) for areas outside their core competence, recognizing the limits of their own knowledge.

C. Developing Financial Self-Efficacy

Financial Self-Efficacy is the deep-seated belief in one’s own ability to manage money and achieve financial goals, regardless of external circumstances. This belief system is critical for weathering economic storms.

-

It is built through small, consistent wins: sticking to a budget, paying off a debt, and automating an investment. These small actions create a powerful feedback loop of confidence.

-

This self-belief enables the investor to remain calm and rational during a crisis, trusting that the established plan and principles will ultimately lead to recovery and continued growth.

-

This internal locus of control empowers them to take full responsibility for their financial outcomes, rather than blaming external forces for poor results.

Phase Five: The Psychological Framework of True Wealth

The ultimate psychological goal is not just to accumulate money, but to use that wealth to achieve True Freedom and Purpose. This final phase defines the enduring psychological framework of the financially independent.

Money is simply a medium. The real goal is the control, security, and optionality that money provides, which allows the individual to focus on non-financial pursuits and greater impact.

A. Defining “Enough” and Purpose

A critical psychological step is the rigorous definition of “Enough”—the specific FI Number that satisfies all financial needs—and aligning that number with a non-financial Purpose.

-

Without defining enough, the accumulation goal is infinite, leading to unnecessary stress, overwork, and a constant feeling of inadequacy, regardless of portfolio size.

-

Once enough is defined and achieved, the wealth is leveraged to pursue meaningful, non-monetary goals, such as philanthropy, creative work, or spending time with family.

-

This clarity prevents the common “golden handcuffs” scenario, where high earners remain trapped in miserable jobs long after they are financially able to leave.

B. Practicing Gratitude and Generosity

The wealthy mindset often incorporates Gratitude and Generosity, viewing their financial success not just as a personal achievement but as a platform for positive impact.

-

Gratitude for their circumstances helps prevent the destructive psychological trap of constant comparison and jealousy of others’ wealth.

-

Generosity, whether through direct philanthropy or strategic giving, provides a profound, non-monetary return on investment by reinforcing a sense of purpose and connection.

-

This outward focus counteracts the psychological isolation that can sometimes accompany immense financial success.

C. Maintaining Flexibility and Optionality

The final psychological state is one of Flexibility and Optionality. Wealth provides the ability to make choices based on desire and value, not on financial necessity.

-

This optionality is the ultimate goal: the ability to choose when, where, and how you work (or don’t work), and the peace of mind knowing that unexpected setbacks are manageable.

-

The mindset continuously seeks ways to simplify systems and automate tasks, reducing the ongoing effort required to manage the wealth itself.

-

True financial freedom is the psychological comfort derived from knowing your core needs are perpetually covered, allowing your mind to focus on creative contribution rather than basic survival.

Conclusion

Mastering the Psychology of Wealth Building is demonstrably more crucial than technical financial knowledge, serving as the essential, internal framework that sustains the long-term discipline necessary for accumulating significant financial assets. This journey begins with the fundamental behavioral shift of Delayed Gratification, demanding the conscious prioritization of future financial security over immediate, ephemeral consumption and reinforcing this choice through the crucial practice of Automating Savings.

The successful investor adopts an Abundance Mindset, enabling them to view money as a resource to be deployed rather than a commodity to be hoarded, fostering a willingness to engage in Calculated Risk-Taking and embrace failure as a temporary learning event. The preservation of this accumulated wealth requires Emotional Discipline to override the primal impulses of fear and greed during market volatility, relying instead on the rational certainty provided by a consistent Investment Routine.

Ultimately, this psychological framework is solidified by an unwavering commitment to Financial Literacy and the intellectual humility required to continuously learn, culminating in the highest form of wealth: the Optionality and Freedom to live a life driven by purpose rather than financial necessity.