The Quest for Financial Autonomy

In the modern economic landscape, the traditional path of trading time directly for money—the conventional nine-to-five job—is increasingly recognized as a fundamentally limited model for achieving true Financial Independence and sustained wealth. While a salary provides stability and necessary immediate income, it inherently restricts your earning potential to the finite number of hours you can physically work, creating a ceiling that prevents exponential growth and often leads to burnout and stress.

The strategic pursuit of Passive Income, however, offers a powerful, paradigm-shifting alternative, enabling you to build assets that generate cash flow automatically, long after the initial effort of creation has been completed. This financial alchemy is about leveraging your time, expertise, and capital upfront to construct systems—digital, financial, or physical—that continue to produce income with minimal ongoing maintenance, ultimately freeing your time to pursue passions or focus on higher-value activities.

Mastering the art of setting up these automated revenue streams is the essential, game-changing step toward achieving genuine Financial Autonomy, where your expenses are covered not by your active labor, but by the relentless work of your assets.

Phase One: Defining and Deconstructing Passive Income

The term “passive income” is often misunderstood. It does not mean income generated with zero effort; rather, it means income generated with Minimal Ongoing Effort after an initial, significant investment of time or capital.

Understanding this distinction is crucial for setting realistic expectations. True passive income involves front-loading the effort to create a self-sustaining system.

A. The Effort-to-Income Spectrum

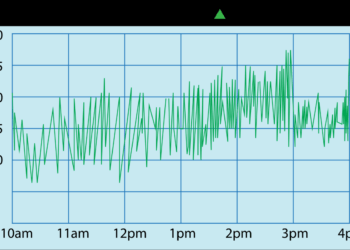

Passive income exists on a Spectrum defined by the required initial effort (time) versus the required capital investment (money). Recognizing where an idea falls is key to choosing the right strategy.

-

High Effort, Low Capital: This includes creating digital products like online courses or e-books. The income is passive, but the creation requires a massive initial time investment.

-

Low Effort, High Capital: This includes financial investments like dividend stocks or rental properties. The setup is simple, but it requires a substantial pool of money to start.

-

The goal is to move beyond the high-effort, low-capital phase into a system where your existing assets (capital or intellectual property) do the heavy lifting for you.

B. The Crucial Role of Scalability

A key characteristic of effective passive income streams, particularly digital ones, is their Scalability. An asset that can be sold infinite times without re-creation is highly scalable.

-

A service business (like freelance writing) is Not Scalable because your earnings are capped by the hours you work, meaning it is active income.

-

A digital product (like a template or an app) is Highly Scalable. Once created, it can be downloaded by thousands of customers, with the marginal cost of production being near zero.

-

The ability to separate your time from your earnings potential is the hallmark of true passive income and the key to long-term wealth accumulation.

C. The Tax Benefits of Passive Income

In many jurisdictions, passive income is often subject to different Tax Treatments than active income, sometimes offering significant advantages that boost the net financial return.

-

Income from rental properties, for example, often benefits from Depreciation, a non-cash deduction that can legally shelter a significant portion of the cash flow from taxation.

-

Long-term capital gains from investments are typically taxed at lower rates than ordinary earned income, maximizing the compounding effect.

-

Understanding and leveraging these tax advantages is a crucial, often-overlooked step in maximizing the after-taxprofitability of your passive ventures.

Phase Two: Capital-Focused Passive Streams (Money Works)

For individuals who already possess a pool of savings or capital, the fastest and often simplest routes to passive income involve utilizing that money to generate automatic returns.

These strategies leverage the power of Compounding Interest and Diversification. They are highly passive but require a significant financial runway to generate substantial returns.

A. Dividend Stock Investing

Investing in Dividend-Paying Stocks or Exchange-Traded Funds (ETFs) is the classic, highly passive method of generating income from the financial markets.

-

These companies or funds regularly distribute a portion of their profits to shareholders, which is paid out as a cash dividend. This cash flow is entirely passive.

-

For maximum compounding, use a Dividend Reinvestment Plan (DRIP), which automatically uses the received dividends to purchase more shares, accelerating the growth exponentially.

-

Focus on Blue-Chip Companies with a long history of increasing their dividend payments (Dividend Aristocrats) for stability and consistent income growth.

B. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) provide a highly liquid, non-physical way to generate passive income from real estate, without ever dealing with a tenant or a leaky faucet.

-

REITs own and manage income-producing properties (malls, apartments, warehouses) and are legally required to distribute at least $90\%$ of their taxable income to investors.

-

They trade like stocks on public exchanges, offering high liquidity and diversification across geographic areas and property types with minimal capital.

-

The income stream is stable, often growing, and provides an essential hedge against inflation, as property values and rental rates tend to increase with the cost of living.

C. Peer-to-Peer (P2P) Lending

Peer-to-Peer (P2P) Lending involves using online platforms to lend money directly to individuals or small businesses, bypassing traditional banks and earning high interest rates.

-

The platform manages the risk assessment and loan servicing, while the investor passively collects interest payments over the life of the loan.

-

This strategy carries Higher Risk than traditional bonds, as loans can default. Diversification across hundreds of small loans is essential to mitigate this risk.

-

P2P lending often offers higher potential returns than savings accounts or conservative bonds but should only be allocated a small, non-essential portion of the investment portfolio.

Phase Three: Digital Passive Streams (Time/Skill Works)

For those with limited capital but abundant time, expertise, or creativity, the digital landscape offers scalable opportunities to create assets that earn income $24/7$.

These strategies require massive initial effort to create a high-quality product. The resulting income is highly scalable since the asset can be sold infinitely.

A. Creating and Selling Digital Products

The creation of Digital Products—such as e-books, printable templates, high-quality stock photos, or specialized software plug-ins—is a highly scalable passive income stream.

-

Identify a specific, small problem faced by a niche audience and create a simple, elegant solution (e.g., a budgeting spreadsheet template for freelancers).

-

Once the product is created, the distribution and sales process is automated through platforms like Etsy, Gumroad, or your own simple e-commerce site.

-

The only ongoing effort is occasional customer service and platform maintenance, making the income stream highly leveraged against the initial creation time.

B. Launching an Automated Online Course

An Online Educational Course leverages existing expertise into a high-value, scalable digital product. This is one of the most lucrative digital passive streams.

-

Choose a skill you possess (e.g., advanced Excel, video editing, specific programming language) and record a comprehensive, high-quality series of video lessons.

-

Host the course on platforms like Teachable, Udemy, or Skillshare, which handle payment processing, hosting, and often marketing for a fee.

-

The income is passive, as students pay and access the content automatically. Ongoing maintenance is limited to periodic updates to keep the content relevant.

C. Affiliate Marketing on Content Sites

Affiliate Marketing involves earning a commission by promoting another company’s products on a blog, niche website, or social media channel.

-

The investor creates Valuable Content (e.g., detailed product reviews, “best of” lists, comparison guides) that naturally attracts an audience searching for solutions.

-

When a visitor clicks the unique affiliate link embedded in the content and makes a purchase, the content creator earns a percentage of the sale.

-

Once the content is published and optimized, it can generate traffic and commissions passively for years, making the income stream highly reliant on initial content creation effort.

Phase Four: Maximizing and Automating Passive Systems

True passive income requires meticulous automation, rigorous expense control, and strategic scaling. The less you are actively involved in the day-to-day operation, the more passive the income truly becomes.

These strategies shift the focus from creation to optimization. Systems and outsourcing are the final steps to achieving maximum detachment from the income generation.

A. Outsourcing and Delegation

For income streams that require minor ongoing tasks (like website maintenance or customer service for a digital product), Outsourcing and Delegation are essential to maintain passivity.

-

Hire virtual assistants (VAs) on a contract basis to handle routine, low-value tasks like replying to simple support emails or updating product listings.

-

The goal is to eliminate all tasks that require your active time, even if it means sacrificing a small percentage of the total revenue to the VA’s fee.

-

Your time is then freed up to focus on the high-value, strategic work of creating new passive assets or optimizing existing ones.

B. Leveraging Automated Marketing Funnels

For digital products and courses, an Automated Marketing Funnel is the engine that drives continuous, passive sales without the need for manual daily promotion.

-

This funnel typically involves a sequence: traffic is driven by passive content (SEO/Affiliate marketing) to a free offer (e.g., a free template), which captures the customer’s email address.

-

A pre-written, automated email sequence then delivers value and gently pitches the core paid product over several weeks.

-

Once the emails are written and the system is set up, it generates leads and sales automatically, providing continuous, passive revenue generation.

C. Systematic Reinvestment of Profits

For both capital-focused and digital streams, Systematic Reinvestment of a Portion of the Profits is crucial for compounding growth and scaling the operation.

-

Avoid the temptation to spend $100\%$ of the initial passive income. Instead, dedicate a fixed percentage (e.g., $50\%$) to reinvestment.

-

For financial assets, reinvestment means buying more shares (DRIP). For digital assets, it means investing in paid advertising, better software, or hiring a designer to create a new product.

-

This disciplined reinvestment strategy ensures the asset base—and therefore the income generated—is continuously compounding and growing over time.

Phase Five: Risk Management and Legal Structures

Even passive income streams carry risk: market risk for financial assets, platform risk for digital assets, and legal risk for property ownership. Structural protection is necessary for stability.

Protecting the passive income stream involves separating the asset from personal liabilities. Legal and financial structures provide the necessary layer of insulation.

A. Utilizing Low-Cost Diversification Tools

For financial assets, risk management relies heavily on using Low-Cost Diversification Tools to neutralize idiosyncratic risk associated with single companies or assets.

-

Do not buy individual stocks. Instead, use broad Index ETFs that track the entire market (like VTI or VOO) to minimize the risk of a single company failure.

-

For P2P lending, ensure your investment is spread across the minimum number of loans required by the platform to fully diversify the credit risk.

-

Diversification is the ultimate defense against the unpredictable nature of all market-based passive income streams.

B. The Role of Legal Entities

For physical assets like real estate or high-value digital businesses, establishing a formal Legal Entity (such as a Limited Liability Company, or LLC) is essential for liability protection.

-

An LLC separates your business assets from your personal assets. If a tenant sues the property owner, the lawsuit is generally limited to the business assets within the LLC, protecting your home and personal savings.

-

This separation also provides clarity for accounting purposes and is often required for taking on certain commercial loans.

-

Always consult with a qualified business attorney to ensure the legal structure is correctly set up for your specific jurisdiction and asset type.

C. Hedging Against Platform Risk

Digital income streams often carry Platform Risk—the reliance on an external company (like Amazon, YouTube, or Apple) that can change its algorithms, policies, or fee structure without warning.

-

Always strive to Own Your Platform (a private website, an email list) where the sales and customer relationship are controlled entirely by you, minimizing reliance on rented spaces.

-

Diversify across multiple platforms. If one channel (like an Etsy shop) is hit by an algorithm change, the income from other channels (like a direct website or Udemy course) remains unaffected.

-

Relying on a single platform for $100\%$ of your digital income is a dangerous form of asset concentration.

Conclusion

Earning Money While You Relax is the achievable goal of strategically leveraging initial effort and capital to construct scalable, automated systems that generate revenue streams with minimal subsequent maintenance. This powerful financial shift necessitates a clear understanding of the Effort-to-Income Spectrum, prioritizing the creation of assets that offer high Scalability and the crucial ability to be sold infinitely without the need for re-creation.

The two primary paths involve either deploying existing capital into high-yield financial assets like Dividend Stock ETFs and REITs, which provide returns with minimal active management, or investing time to create Digital Products and Automated Online Courses, which leverage expertise into highly scalable, passive revenue.

To achieve true financial detachment, the investor must implement Rigorous Automation through marketing funnels and outsource low-value tasks to virtual assistants, thereby allowing their time to be reinvested into creating new assets. Ultimately, the stability and longevity of these passive income streams are protected through Systematic Reinvestment of a portion of the profits and structural defense provided by Legal Entities and Robust Diversification across all asset types.