The journey toward true financial freedom is often misunderstood as a simple race to save as much cash as possible in a stagnant bank account. In reality, achieving lasting independence requires a fundamental shift from being a consumer of products to becoming an owner of generative assets.

Generative assets are specific types of investments that work tirelessly in the background, producing cash flow or appreciating in value without requiring your constant physical presence. This transition allows you to decouple your time from your income, breaking the cycle of trading hours for dollars that keeps so many people tethered to a traditional desk job.

By understanding the mechanics of compounding and asset allocation, you can build a self-sustaining economic engine that provides for your lifestyle indefinitely. It is about creating a fortress of wealth that is resilient enough to withstand market fluctuations and inflation over the long haul.

This guide is designed to deconstruct the most effective strategies for identifying, acquiring, and scaling these assets to accelerate your path to freedom. We will explore the psychological barriers to wealth and the practical steps needed to turn a modest income into a powerful legacy of prosperity.

The Fundamental Logic of Asset Generation

Before you can build wealth, you must understand exactly what constitutes a generative asset versus a liability that drains your resources. A generative asset puts money in your pocket, while a liability takes it out through maintenance, interest, and depreciation.

A. Analyze your current balance sheet to distinguish between “dead” cash and working capital.

B. Focus on assets that provide high yields or consistent capital gains over time.

C. Understand that time is the most critical multiplier in the wealth equation.

D. Minimize the ownership of depreciating “status symbols” that offer no return.

E. Reinvest every dollar of profit back into the asset base to trigger exponential growth.

Wealth is not about what you spend; it is about what you own that grows. Most people spend their lives collecting “things” rather than collecting income streams.

Once you stop working for money and start making money work for you, your perspective on life changes. You begin to see every dollar as a “worker” that can be sent out to bring back more friends.

Harnessing the Power of Dividend Growth

Dividend-paying stocks are one of the most accessible generative assets for the average investor. They represent a share in the profits of established, successful companies that distribute cash directly to shareholders.

A. Target “Dividend Aristocrats” which have increased payouts for over twenty-five years.

B. Utilize a Dividend Reinvestment Plan (DRIP) to automate the compounding process.

C. Diversify across various sectors like healthcare, consumer staples, and technology.

D. Evaluate the “payout ratio” to ensure the company can sustain its distributions.

E. Focus on companies with a strong “moat” or competitive advantage in their industry.

Dividends provide a “psychological floor” during market downturns because you are still getting paid even if the stock price drops. This cash flow can be used to buy more shares at a discount during a recession.

Over long periods, the yield on your original investment can grow to double digits. This creates a rising stream of passive income that typically outpaces the rate of inflation.

Real Estate as a Cash Flow Fortress

Real estate remains a favorite for wealth builders because it offers a combination of monthly income, tax advantages, and market appreciation. It is one of the few assets where you can safely use leverage to increase your returns.

A. Identify emerging neighborhoods with high rental demand and low vacancy rates.

B. Calculate the “Cap Rate” and “Cash-on-Cash Return” before making an offer.

C. Screen tenants rigorously to ensure consistent income and lower maintenance costs.

D. Utilize tax deductions like depreciation to protect your rental income from the IRS.

E. Gradually scale from single-family homes to multi-family apartment complexes.

The power of real estate lies in the fact that your tenants are essentially paying off your mortgage for you. This allows you to build massive equity using other people’s money.

Even in a flat market, a well-managed property provides a steady paycheck every month. It is a tangible asset that has intrinsic value regardless of what happens in the digital world.

The Rise of Digital Intellectual Property

In the modern age, assets don’t have to be physical to be generative. Digital products like e-books, online courses, and software can be created once and sold thousands of times with nearly zero marginal cost.

A. Solve a specific, high-value problem for a niche audience through digital content.

B. Build an email list to own the relationship with your customers directly.

C. Use automated funnels to market and sell your products while you sleep.

D. License your photography, music, or code to platforms for recurring royalties.

E. Update your content periodically to ensure it remains a “long-tail” asset.

Digital assets have the highest profit margins of any asset class because there is no inventory. Once the initial work is done, the maintenance is minimal compared to a physical business.

This allows you to reach a global market without the need for expensive storefronts or shipping logistics. Your intellectual property works for you twenty-four hours a day, across every time zone.

Strategic Business Ownership and Private Equity

Owning a piece of a profitable business is the fastest way to achieve “escape velocity” in your wealth journey. You don’t necessarily have to be the CEO to benefit from the growth of a private enterprise.

A. Invest in small, local businesses with proven cash flow and strong management.

B. Consider “search funds” where you back an entrepreneur to buy and run a company.

C. Develop a side hustle that eventually becomes a hands-off, managed business.

D. Buy into franchises that offer a proven system and a recognized brand name.

E. Focus on businesses with recurring revenue models, such as subscription services.

A business is a living entity that can adapt to market changes much faster than a fixed asset. It is a vehicle for creating immense value and solving problems at scale.

If you can build a business that operates without your daily involvement, you have created the ultimate generative asset. This provides both the money and the time to enjoy your life.

Mastering the Art of Index Fund Investing

For those who prefer a “set it and forget it” approach, low-cost index funds offer a way to own the entire market. This strategy removes the risk of picking individual losers while capturing the overall growth of the economy.

A. Minimize management fees by choosing low-expense ratio funds.

B. Invest a fixed amount every month regardless of market conditions (Dollar Cost Averaging).

C. Choose broad-market indices like the S&P 500 or Total World Market.

D. Rebalance your portfolio once a year to maintain your target risk level.

E. Stay invested through the volatility to capture the long-term upward trend.

Index funds are the most efficient way to achieve market-average returns, which historically beat most professional stock pickers. They provide instant diversification across hundreds of different companies.

By automating your investments, you remove the emotional stress of trying to time the market. Success in index investing is determined by your “time in the market,” not your ability to predict the future.

Protecting Wealth Through Asset Allocation

Building wealth is only half the battle; you must also protect it from being wiped out by a single catastrophic event. Diversification across different asset classes is your best defense.

A. Balance your portfolio between aggressive growth assets and stable income assets.

B. Keep a portion of your wealth in liquid “safe haven” assets like gold or cash equivalents.

C. Understand the correlation between different assets to ensure they don’t all fall at once.

D. Adjust your allocation as you move closer to your target independence date.

E. Use insurance products to transfer catastrophic risks away from your net worth.

Asset allocation is the only “free lunch” in the investing world. It allows you to achieve higher returns for every unit of risk you take on.

A well-balanced portfolio behaves like a shock absorber for your wealth. When one sector is struggling, another is often thriving, keeping your total net worth stable.

The Psychology of the Long-Term Investor

Most people fail to build wealth not because they are bad at math, but because they are bad at managing their emotions. Developing a “stoic” mindset is essential for staying the course.

A. Ignore the daily noise of financial news and social media hype.

B. Focus on the process and the habits rather than the daily fluctuations of your net worth.

C. View market crashes as “clearance sales” where assets are available at a discount.

D. Develop the discipline to say “no” to lifestyle inflation as your income grows.

E. Celebrate your milestones privately to avoid the “prestige trap” of showing off wealth.

Fear and greed are the two biggest enemies of the wealth builder. Greed makes you take unnecessary risks, while fear makes you sell at the bottom.

If you can stay calm when everyone else is panicking, you will inevitably come out ahead. Wealth building is a marathon, and the prize goes to those who can endure the boredom of waiting.

Tax Optimization as a Wealth Multiplier

Taxes are likely your single largest lifetime expense. Learning how to legally minimize your tax burden can add years of retirement income to your plan.

A. Maximize contributions to tax-advantaged accounts like 401(k)s and IRAs.

B. Understand the benefits of Long-Term Capital Gains rates over Ordinary Income.

C. Use 1031 exchanges in real estate to defer taxes on property sales.

D. Harvest “tax losses” to offset your gains and lower your total bill.

E. Consider the tax implications of where you choose to live and work.

A dollar saved in taxes is more valuable than an extra dollar earned because you don’t have to pay taxes on the savings. Tax efficiency is a hidden lever that accelerates your compounding.

Always consult with a professional to ensure you are following the latest laws and regulations. The rules change often, and staying informed can save you a fortune over several decades.

Generating Income Through Options Trading

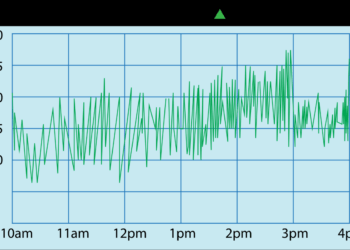

For more advanced investors, selling options can be a way to generate “rent” from your existing stock portfolio. This strategy turns market volatility into a source of income.

A. Sell “Covered Calls” on stocks you already own to collect premium income.

B. Use “Cash-Secured Puts” to get paid for waiting to buy stocks at a lower price.

C. Focus on high-quality companies that you would be happy to own anyway.

D. Understand the risks of “leverage” and avoid overextending your margin.

E. Treat options trading as a professional business with strict risk management rules.

Options can be dangerous if used for gambling, but they are powerful when used for income generation. They allow you to extract profit from a flat or slightly declining market.

It is a skill that takes time to learn, but it provides a unique way to hedge your portfolio. Think of it as an insurance policy where you are the one collecting the premiums.

The Importance of High-Income Skills

Your ability to earn a high income in the early stages of your life is the “fuel” for your wealth engine. You should constantly be investing in yourself to increase your market value.

A. Master skills that are in high demand and low supply, such as AI, sales, or coding.

B. Build a personal brand that establishes you as an authority in your field.

C. Network with people who are further ahead in their journey than you are.

D. Learn the art of negotiation to ensure you are paid what you are worth.

E. Stay curious and keep learning new technologies that disrupt your industry.

The more you earn, the more you can invest, and the faster you reach financial independence. Even a 10% increase in your salary can cut years off your retirement timeline if invested wisely.

Your brain is the ultimate generative asset. It is the only thing that cannot be taken away from you and can produce value in any economic environment.

Peer-to-Peer Lending and Private Debt

The digital age has opened up the world of private lending to individual investors. You can now act as the bank, lending your money directly to individuals or small businesses for a fixed return.

A. Use platforms that allow you to diversify your loans across hundreds of borrowers.

B. Focus on “secured” debt where there is collateral backing the loan.

C. Understand the default rates and risk profiles of different lending tiers.

D. Reinvest your interest payments immediately to keep your capital working.

E. Use P2P lending as a small “satellite” portion of your overall portfolio.

Private debt often offers higher yields than traditional bonds or savings accounts. However, it comes with higher risk, so it should never be your only investment.

It is a great way to generate monthly cash flow that is not directly correlated with the stock market. It adds another layer of diversification to your wealth fortress.

Building a Legacy and Generational Wealth

Wealth is not just about you; it is about the impact you leave on your family and the world. Planning for the transfer of your assets is the final step in the mastery of money.

A. Create a trust to protect your assets from legal disputes and excessive taxes.

B. Teach your children the value of a dollar and the mechanics of investing early.

C. Define your philanthropic goals and how you want your wealth to be used for good.

D. Keep meticulous records of all your accounts, passwords, and legal documents.

E. Review your estate plan every few years to account for changes in your family or the law.

Generational wealth can be a blessing or a curse depending on how it is handled. Without financial education, most family fortunes are lost within three generations.

True success is building something that lasts long after you are gone. Your wealth should be a tool that empowers future generations to pursue their own meaningful work.

Conclusion

Achieving financial independence is a journey that requires both strategy and patience. You must prioritize the acquisition of generative assets over temporary consumer pleasures. Every small investment you make today serves as a building block for your future. Diversification is your shield against the unpredictable nature of the global economy.

The psychological ability to stay disciplined is more important than any specific trade. Time is the most powerful ally you have in the pursuit of exponential growth. Do not let fear or greed dictate your long-term investment decisions. Your income potential is a reflection of the value you provide to the marketplace.

Continuous education is the only way to stay ahead in a rapidly changing world. Wealth is a tool that provides the freedom to live life on your own terms. Commit to the process and trust that your efforts will bear fruit in time. The best time to start building your generative asset base was yesterday; the second best time is now.